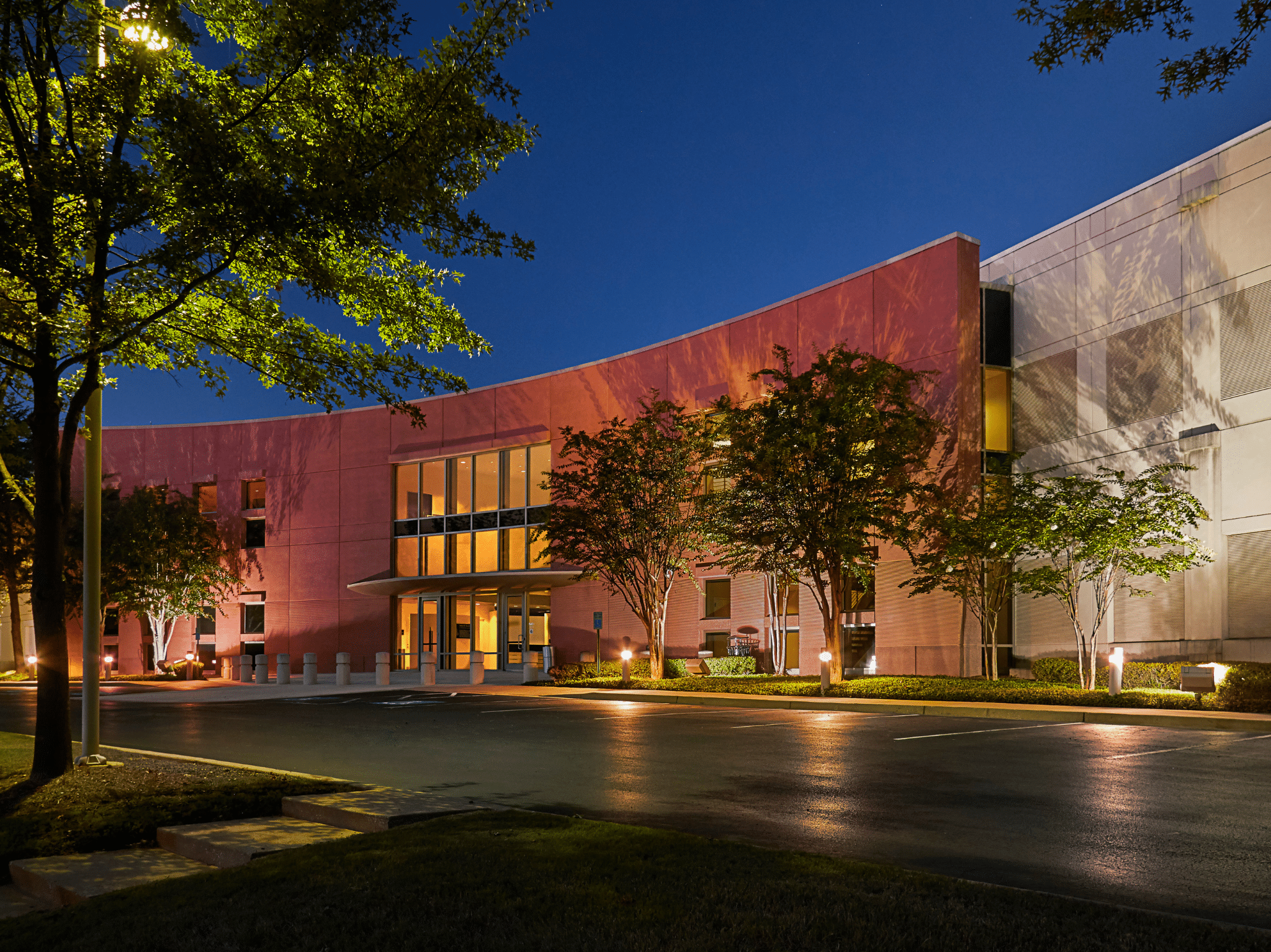

Switch Center

Critical Infrastructure

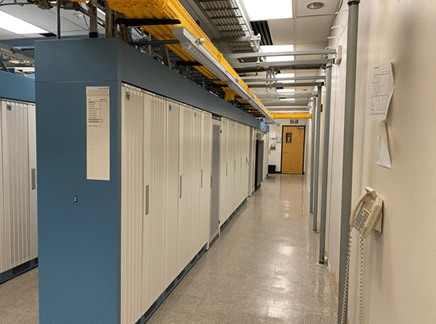

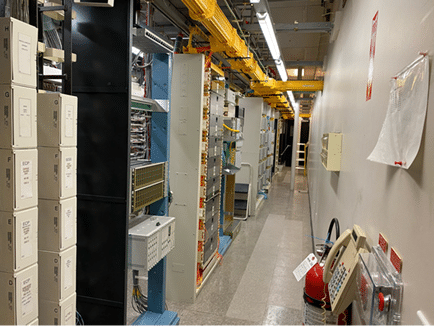

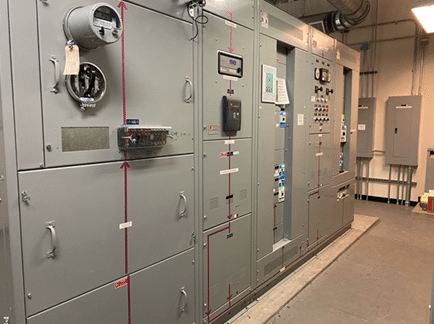

The property is a switch center located in Ontario, CA, a facility that is serving multiple critical purposes to the company’s core business operations. The asset is strategically positioned to support over 1,000 cell phone towers in the L.A. basin, as well as parts of Nevada and Arizona. Built in 1982, the 1.68-acre site features 17,132 rentable square feet. The investment-grade tenant has occupied the data center since 1997 and is in the process of spending over $10M at the site, showing a long-term commitment to the location.

RISK FACTORS

An investment in Aphorio Carter Critical Infrastructure Fund, LLC (the “Fund”) is subject to various risks which could cause the value of our

units to decline and could cause you to lose all or part of your investment. Those risks include, but are not limited to, the following:

• There is no public market for the units and such units will not be registered with the Securities and Exchange Commission or the securities commissions of any state or country;

• The Fund is a newly formed business entity with a limited history of operations and limited assets. The Fund is subject to the risks involved with any speculative new venture. No assurance can be given that the Fund will be profitable;

• The Fund may suffer delays in identifying suitable investment opportunities;

• Our ability to raise sufficient capital in this offering;

• The units are not liquid investments;

• Our manager’s duties to unitholders is limited;

• Unitholders having limited voting rights with respect to the management or operations of the Fund or in connection with investment decisions;

• Our manager has the ability to change our targeted investments and investment objectives without unitholder consent;

• The Manager and its affiliates are engaged in other activities and intend to continue to engage in such activities in the future, including other real estate ventures. The Manager and its affiliates and their principals will therefore have conflicts of interest in allocating management time, services and functions between various existing enterprises and future enterprises the Manager and its affiliates and their principals may organize, as

well as other business ventures in which the Manager, its affiliates and their principals may be or may become involved

• The total amount of Offering Proceeds and the number of Investments acquired by the Fund is uncertain. It is possible that the Fund will only purchase a few Investments, limiting the diversification of the Investments of the Fund and increasing the risk of loss to investors.

• Various risks inherent in real estate investing including, without limitation, natural disasters such as hurricanes and floods, changes in national and local economic conditions, changes in the investment climate for real estate investments, changes in the demand for, or supply of, competing properties, changes in the local market conditions and neighborhood characteristics, the availability and cost of mortgage funds, the obligation to

meet fixed and maturing obligations, changes in real estate tax rates and operating expenses, changes in governmental rules and fiscal policies, changes in zoning and other land use regulations, environmental controls, changes or fluctuations in supply of services, and changes in regulatory and environmental laws relating to technology related assets, among other factors;

• Restrictions and risks associated with applicable encroachments, covenants, conditions, restrictions, rights of way, and easements that affect or could impact our investments;

• The cost of compliance with all laws, rules, and regulations applicable to the Fund and its underlying investments;

• Risks associated with tax considerations, including federal and state tax liabilities and obligations, unrelated business income tax applicable to tax-exempt unitholders, and ability of the Fund’s subsidiaries to qualify as real estate investment trusts for tax purposes;

• The possibility of environmental risks relating to the properties, including changes in laws that affect the generation and consumption of energy usage generally or that affect data centers and other technology related assets specifically, which may be in the form of greater regulatory oversight based upon climate change measures, taxes or assessments on energy consumption and generation, among others;

• Risks associated with the terms on which our properties are acquired, including the use of leverage;

• Risks relating to the terms of financing obtained in connection with the acquisition of the properties;

• Customary restrictions, covenants, representations and warranties, and obligations contained in loan documents in connection with the financing of the properties, and the risks associated with the events of default thereunder, including foreclosure of the properties;

• Disruptions in the capital markets and fluctuations in economic conditions could adversely impact the Fund;

• Joint ventures and other equity investments could increase our risk profile; and

• Our unitholders may not realize a return on their investment for years, if at all.

PRIOR PERFORMANCE DISCLAIMER

While our sponsor’s principals and affiliates were able to generate attractive returns in prior, unrelated funds (the “Prior Funds”), this Fund is focused upon the acquisition of digital and mission critical infrastructure and other technology related real estate assets. While our manager and sponsor believe the Fund will be able to benefit from the past experience and knowledge of its principals, there is no assurance this Fund will achieve the projected returns. Prospective investors should not assume that an investment in this Fund will generate returns comparable to the returns generated by the Prior Funds.

Company

Aphorio Carter

Location

Ontario, CA

Overview

Located in Ontario, CA, this Switch Center features a tenant who operates as a wireless network operator and provides investment-grade tenancy.

Aphorio Carter is led by an experienced team of data center real estate experts that specialize in the management of alternative investments, sourcing accretive acquisitions in high-growth markets and developing systematic real estate support services to add long-term value.