LOUISVILLE, KENTUCKY – February 20, 2025 – Aphorio Carter Critical Infrastructure Fund, LLC (“Aphorio Carter”), a 506(c) private placement offering specializing in critical infrastructure and data center investments, today announced the acquisition of the Louisville Data Center in Louisville, KY, and the Simpsonville Data Center in Simpsonville, KY, for a combined purchase price of approximately $35 million.

The two properties operate as enterprise data centers located in the Louisville MSA. Louisville is a growing data center market due to low operating costs, robust infrastructure, strategic location, and increasing connectivity. With a total market size of 513,102 square feet of data center space, Louisville is well-positioned as a second-tier market for enterprises and colocation providers. With no new supply on the horizon, Louisville’s existing data centers are well-positioned to benefit from sustained demand growth, driving increased occupancy and long-term stability in the region.

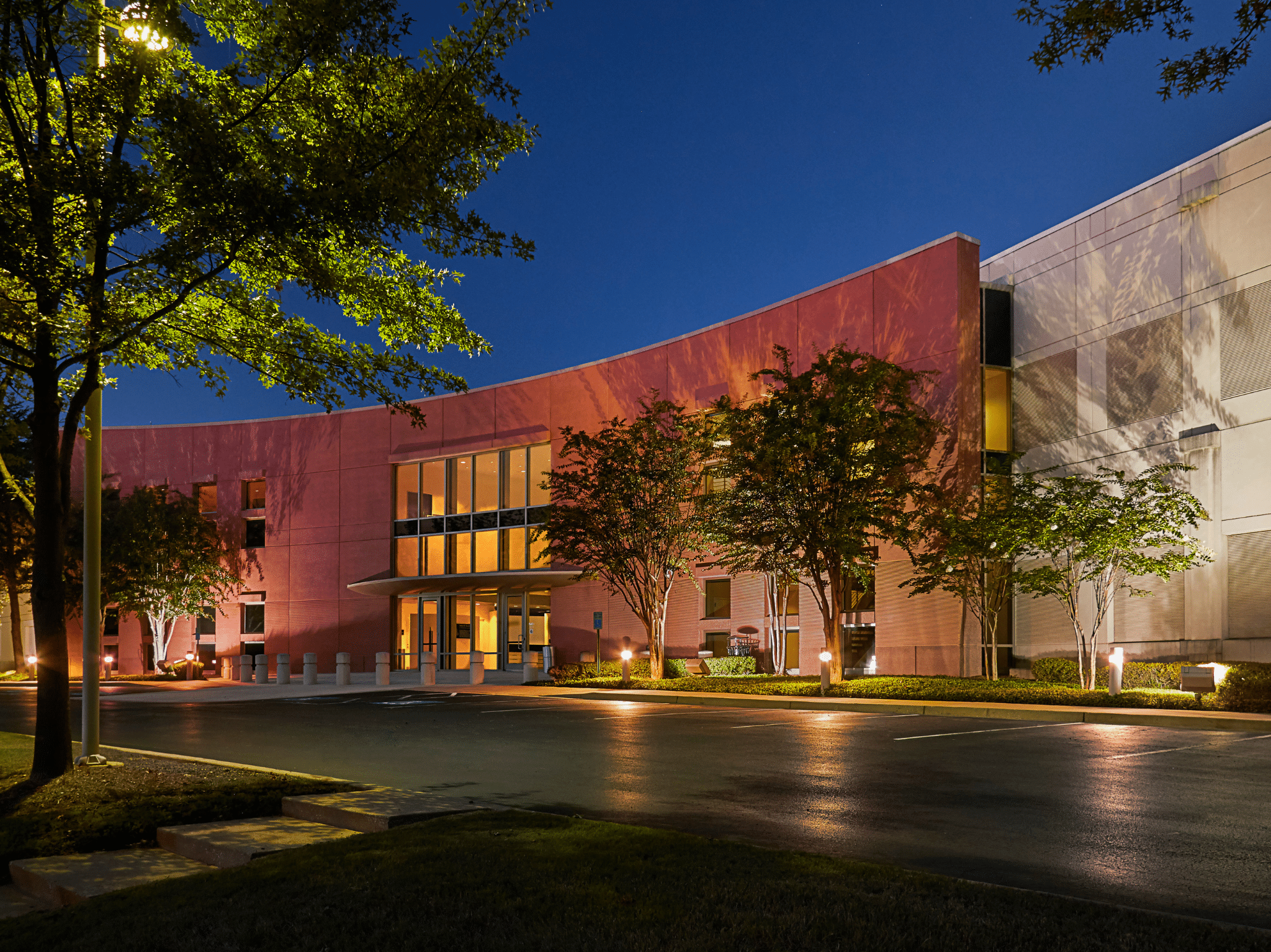

Although two separate facilities, both the Louisville and Simpsonville properties were built in 2011, have 1,000 kW of critical power, are Tier III LEED Gold-certified, 102,500 square feet, and have the same Fortune 200 tenant. Both sites are equipped with 10,000 square feet of raised floor space and are well positioned for long-term value growth with an additional 10,000 square feet of shell space for future expansion. The Louisville Data Center sits on 30 acres while the Simpsonville Data Center occupies 21 acres.

Each data center supports up to 1MW of critical IT load with an N+1 UPS configuration and a PUE of 1.7 for optimized energy efficiency. Both sites are strategically designed for high availability, each featuring dual 3,300 HP, 2 MW generators, and two utility feeds—LG&E at the Louisville facility and Kentucky Utilities at the Simpsonville facility.

“These data center investments expand Aphorio Carter’s portfolio into the Louisville market with strong fundamentals, further enhancing portfolio diversification. Louisville is emerging as a prime data center market, offering a strategic blend of low operating costs, robust fiber infrastructure, and access to major markets like Chicago and Atlanta. With affordable energy, tax incentives, and a business-friendly environment, this market presents a compelling opportunity for long-term growth in the digital infrastructure sector,” said John Regan, chief investment officer of Aphorio Carter.

These data centers mark Aphorio Carter Critical Infrastructure Fund’s eighth and ninth critical infrastructure real estate purchases since the company’s first acquisition in June 2022. These latest additions bring the fund’s total assets under management to approximately $238 million, reinforcing its commitment to building a strong, aggregated portfolio of strategic investments in critical infrastructure and data centers.

About Aphorio Carter

Aphorio Carter is a Carter Funds company investing in high-quality income-producing mission-critical infrastructure, data centers, switch sites, and high-growth technology-related real estate. Led by an experienced team that has acquired more than 125 data centers across the world, Aphorio Carter specializes in sourcing and managing accretive digital infrastructure real estate and implements systematic support services aimed at adding long-term value on behalf of the investment funds the company manages. Together, the principals of Aphorio Carter have a century of real estate and transaction experience in the digital infrastructure space totaling an excess of $5.3 billion in value. Aphorio Carter targets acquisitions that are net-leased to creditworthy tenants and include wholesale, enterprise, colocation, edge, switch, and cloud data center properties – the critical real estate that powers the digital age.

Media Contact:

Stacy Sheedy

Vice President, Marketing, Carter Funds

ssheedy@carterfunds.com

813-358-5982