By John Regan, Chief Investment Officer, Aphorio

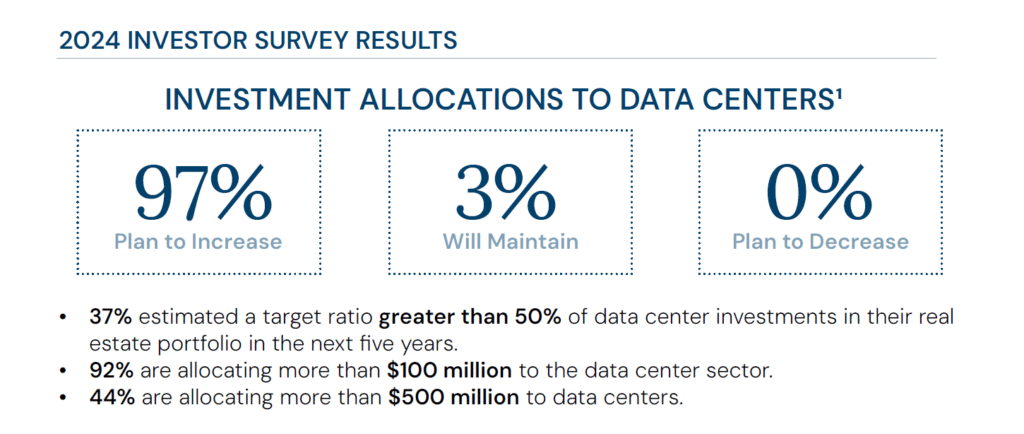

According to a 2024 CBRE survey, 97% percent of respondents (many of whom are the world’s largest institutional real estate investors) plan to increase their capital deployment in the data center sector this year. Investors’ appetite is strong in the higher-yielding opportunistic and value-add segments with solid market fundamentals. In today’s digital age, data centers are becoming increasingly attractive to investors worldwide. Data centers are mission-critical facilities that play a crucial role in the operations and success of the technology behind virtually every business and smart device. As companies increasingly rely on digital infrastructure to drive their revenue-generating operations, the importance of data centers has never been more evident.

According to the survey, several key trends highlight why data centers are an increasingly attractive asset allocation for investors:

-

- Growth in Data Center Demand

The demand for data centers has surged dramatically, driven by the exponential growth in data generation, the proliferation of cloud services, and the increasing adoption of artificial intelligence (AI) and machine learning. The CBRE report indicates that North American data center inventory grew 24.4% year-over-year in the first quarter of 2024, adding 807.5 megawatts (MW) of new capacity. Yet, overall, U.S. data center inventory is still not keeping up with demand.

- Growth in Data Center Demand

-

- Abundant Constraints on New Supply

The massive amount of electricity used by data centers is already straining transmission systems in major markets, resulting in limited developable land where utilities can deliver power as quickly as its needed to operate data centers. Wait times for new grid connections from utilities are now routinely as long as five to seven years in key hubs like Northern Virginia and Columbus, Ohio.In addition, data centers are becoming more and more expensive to build, with the rising cost of land, labor and equipment. At the same time, projects face growing uncertainty around power delivery and continued supply chain volatility that threatens development timelines. Plus, the evolving regulatory landscape and new cybersecurity measures require continuous adaptation and investment. This amounts to significant risk for developers and the capital providers underwriting new data center construction projects. This supply-demand imbalance is a key factor in surging data center tenant rents.

- Abundant Constraints on New Supply

-

- Rising Rental Rates

As demand for data center space outstrips supply, rental rates have increased significantly. In key North American markets, average asking rental rates have risen by 20% to 54% over the past eight months. This trend underscores the competitive landscape for securing data center capacity, with companies willing to pay a premium for reliable and strategically located facilities.

- Rising Rental Rates

-

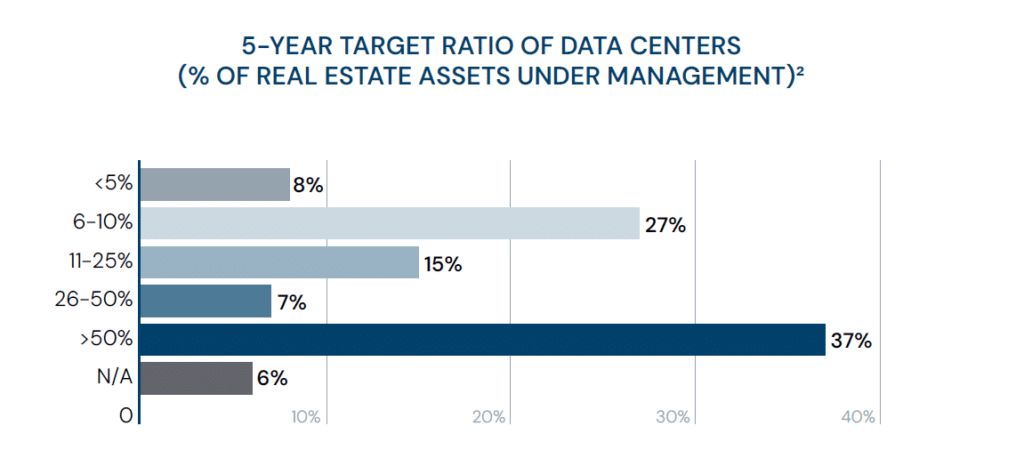

- Increasing Investment Allocations in Data Centers

It’s not surprising that, given these favorable economic fundamentals and the growth in our reliance in technology as a society, investment in data centers has reached unprecedented levels. The report highlights that 92% of surveyed investors are allocating more than $100 million to the data center sector, with 44% committing over $500 million. This surge in investment is a testament to the sector’s perceived value and critical role in supporting digital transformation across industries. Additionally, the appetite for investment in data centers continues to grow, with 17% of respondents planning to invest even more in the space this year – in total, over $2 billion, up 8% from 2023.

- Increasing Investment Allocations in Data Centers

Conclusion

Data centers are the backbone of the digital economy, enabling companies to store, process, and analyze vast amounts of data essential for their operations. As highlighted in the CBRE report, the sector’s growth underscores its critical importance to modern businesses. Companies prioritizing robust data center strategies will be better equipped to navigate the complexities of the digital age and drive sustained success. Data centers are essential to the technology running businesses – and that reliance is only growing. Now is an ideal time for financial advisors and retail investors to follow the lead of institutional investors and consider data centers as part of a diversified, growth-generating investment portfolio. Savvy advisors will take advantage of the solid market fundamentals data centers offer to generate current income for investors. They will also consider the long-term potential of data center investments given the asset class’s projected growth path – one that outperforms all other sectors of commercial real estate today.

About John Regan

John Regan serves as the Chief Investment Officer and has been in the technology and facilities infrastructure space for over three decades. In his most recent role as SVP of Acquisitions and CTO for Landmark Dividend, he executed on over a $1 billion in Digital Infrastructure acquisitions.

Prior to Landmark, Mr. Regan worked with Carter Validus (CV) Advisors where he was instrumental in the development and execution of the CV Mission Critical REIT I & II data center platforms from inception. Mr. Regan made CV’s first acquisition in July 2011. By October 2017, pipeline development and management led to closing over 50 deals, amassing $2 billion of data center assets totaling more than 4.5 million square feet. Mr. Regan is a data center industry leader frequently speaking and moderating at conferences across the U.S. having a number of articles published by and about him.

Mr. Regan’s experience spans over 35 years within information technology, facilities infrastructure, business development, sales and acquisitions serving in various leadership positions while also providing advisory services and consulting for multiple startups. Mr. Regan served in leadership positions for 18 years with PWC, LLP as National Director of Data Center Services, National Director of Network Services, and Director of Infrastructure Delivery. In these roles, Mr. Regan led technology and facilities infrastructure engineers and project managers through the execution of more than 26 million square feet of real estate projects spanning renovations, restacks, retrofits, consolidations, new builds and the merger of technology and facility infrastructure of Coopers & Lybrand and Price Waterhouse.

Mr. Regan achieved recognition by ComputerWorld for PWC as the number one Green IT organization worldwide in 2010 after completion of a state-of-the-art Tier III LEED Gold-certified data center and driving other conservation practices organizationally. Mr. Regan is also an expert in BCDR having developed and executed a multi-tiered program creating PWC’s firm-wide Disaster Recovery program.

Mr. Regan has a bachelor’s degree in Accounting from St. Leo University where he graduated Magna Cum Laude. Mr. Regan holds several certifications in the infrastructure space having achieved Accredited Tier Specialist (ATS), Information Technology Infrastructure Library (ITIL) and Certified Business Continuity Professional (CBCP) credentials. He holds multiple certifications and various systems designations through Digital Equipment Corporation, Research Triangle Institute, and NCSU.

1 – CBRE Global Data Center 2024 Investor Sentiment Survey: https://sprcdn-assets.sprinklr.com/2299/698827d7-eef9-4087-929f-66db986c810d-1088585992.pdf

2 -CBRE, “Global Data Center Trends 2024.” June 24, 2024; CBRE, “2024 Global Data Center Investor Intentions Survey.” June 3, 2024. Learn more about the survey here: https://sprcdn-assets.sprinklr.com/2299/698827d7-eef9-4087-929f-66db986c810d-1088585992.pdf