BURLINGTON, NC – February 12, 2026 – Carter Exchange Fund Management Company, LLC (“Carter Exchange”), a real estate company focused on tax-advantaged investment strategies, today announced the sale of Retreat at the Park (the “Property”), a garden-style apartment community located in Burlington, North Carolina, between Greensboro and Raleigh-Durham.

Carter Exchange sold the Property on January 21, 2026, for $48 million, resulting in a 55.4% total return to investors.* During Carter Exchange’s 5.75-year hold, average monthly rents on occupied units increased by 20.1%, and the average occupancy rate was 95.5%.

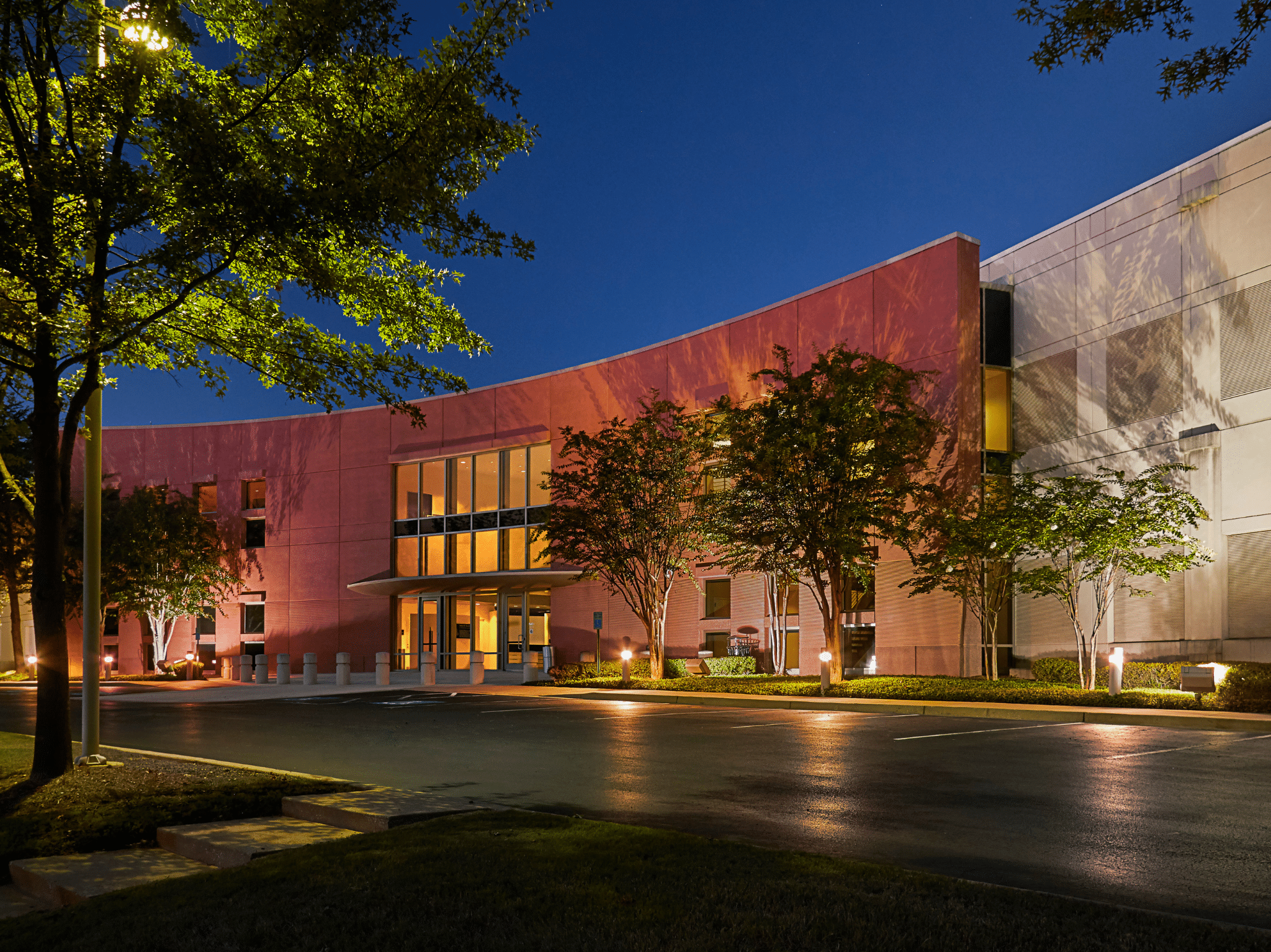

The Property was built in 2015 and consists of 249 apartment homes across 11 residential buildings. In addition to expansive living areas, the community features upscale amenities including a clubhouse with a game room and lounge area, cybercafé, fitness center, resort-style saltwater swimming pool, outdoor entertainment fireplace, and other modern lifestyle offerings.

To enhance value, Carter Exchange’s in-house property management company, Allegiant-Carter Management, implemented apartment home upgrades, including upgraded flooring and the installation of new washers/dryers, generating a 37.7% return on invested capital.

“The sale of Retreat at the Park demonstrates the effectiveness of our acquisition strategy and in-house management capabilities,” said Dallas Whitaker, Chief Executive Officer of Carter Exchange. “The Burlington metro area has experienced meaningful population growth – 12.9% since 2010 – driven by its central proximity to larger employment hubs (Greensboro and Raleigh-Durham). This dynamic has positioned the market as an attractive, more affordable residential alternative. Successful execution of our business plan resulted in a highly marketable asset and a strong outcome for our investors.”

The transaction provided liquidity to investors while also offering the opportunity to reinvest sale proceeds through a subsequent tax-deferred exchange.

Carter Exchange specializes in tax-deferred private placement investments. Currently, the firm manages a portfolio of more than $2.05 billion across multiple asset classes in 10 states, while the broader Carter Funds platform totals $4.3 billion in assets under management, including multifamily, industrial, and data center real estate.

About Carter Funds

Carter Funds is a fully integrated real estate company with $4.3 billion in assets under management and is built on over 300 years of real estate experience. Carter Exchange, a Carter Funds company, is a national real estate investment and management company that sponsors institutional-quality real estate exchange programs intended to qualify for tax deferral under Section 1031 of the Internal Revenue Code. Learn more: www.carterfunds.com and www.carterexchange.com

*The “total return” represents the ratio of total sales proceeds and distributions through the life of the asset over the total initial equity invested, net of fees. These numbers were not audited by a third-party firm. No representation is made that any investment will or is likely to achieve profits or losses similar to those achieved in the past or that losses will not be incurred on future offerings.