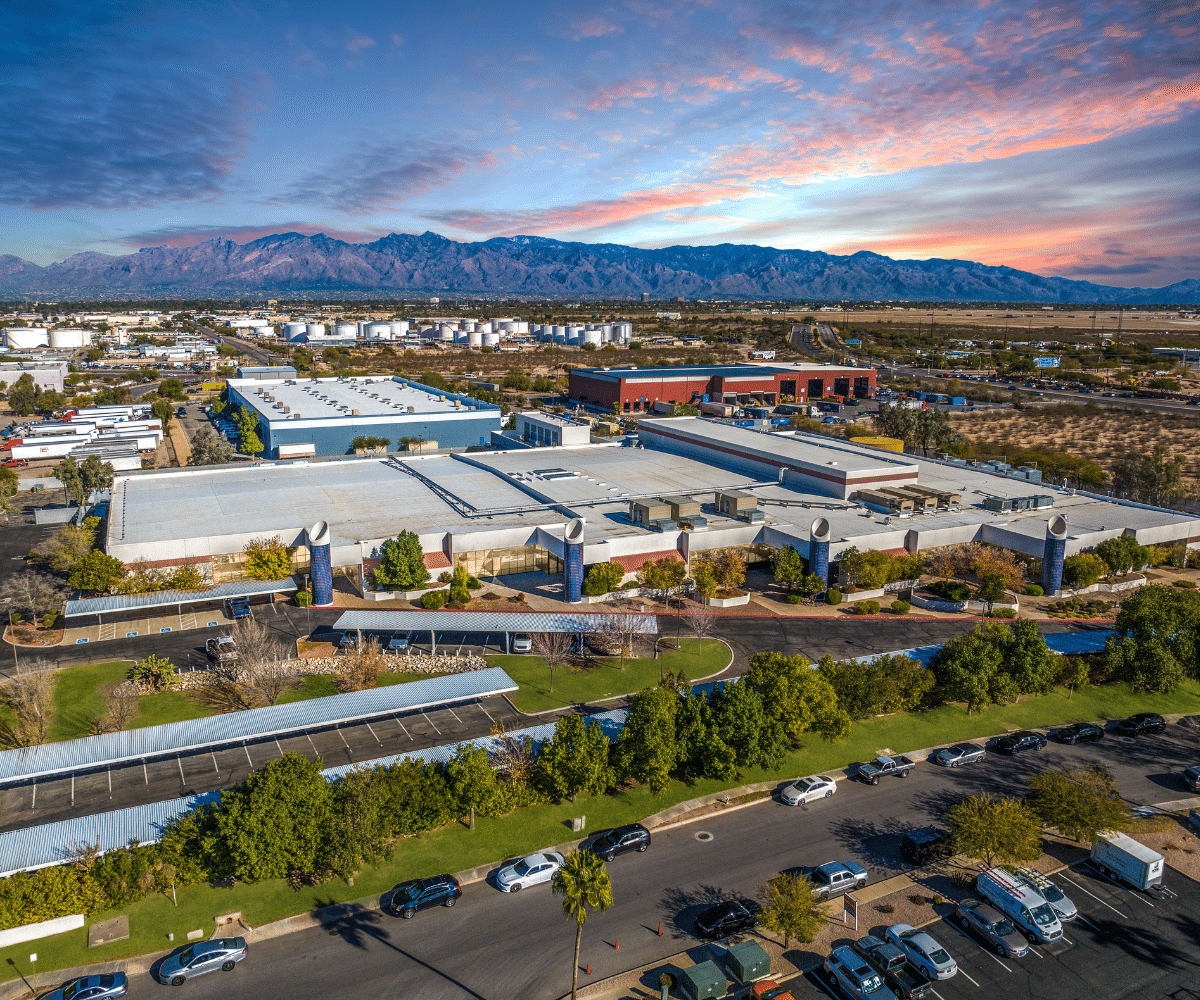

TUCSON, AZ — October 19, 2023 — Aphorio Carter Fund Management Company, LLC (“Aphorio Carter”), the critical infrastructure and data center division of Carter Funds, announced today that it has acquired the Tucson Tech Data Center in Tucson, Arizona for $13M and is planning to spend $8M in improvements to the property. Tucson Tech Data Center is 100% net leased to TECfusions, a data center development and operations entity and energy-efficient microgrid developer and operator. The acquisition marks the fourth data center purchase for Aphorio Carter, an investment management company focused on acquiring high-growth digital and mission-critical infrastructure, data centers, switch sites, and technology-related real estate throughout the U.S.

Tucson Tech Data Center is located 80 miles southeast of Phoenix, AZ, which stands as one of the largest data center markets in the United States. In 2023, rental rates in this region have surged by 30 percent and spaces are being reserved up to two years before their availability.[1] The proximity of the Tucson MSA allows operators to leverage the robustness of the Phoenix market, expanding their reach close to this pivotal data center hub.

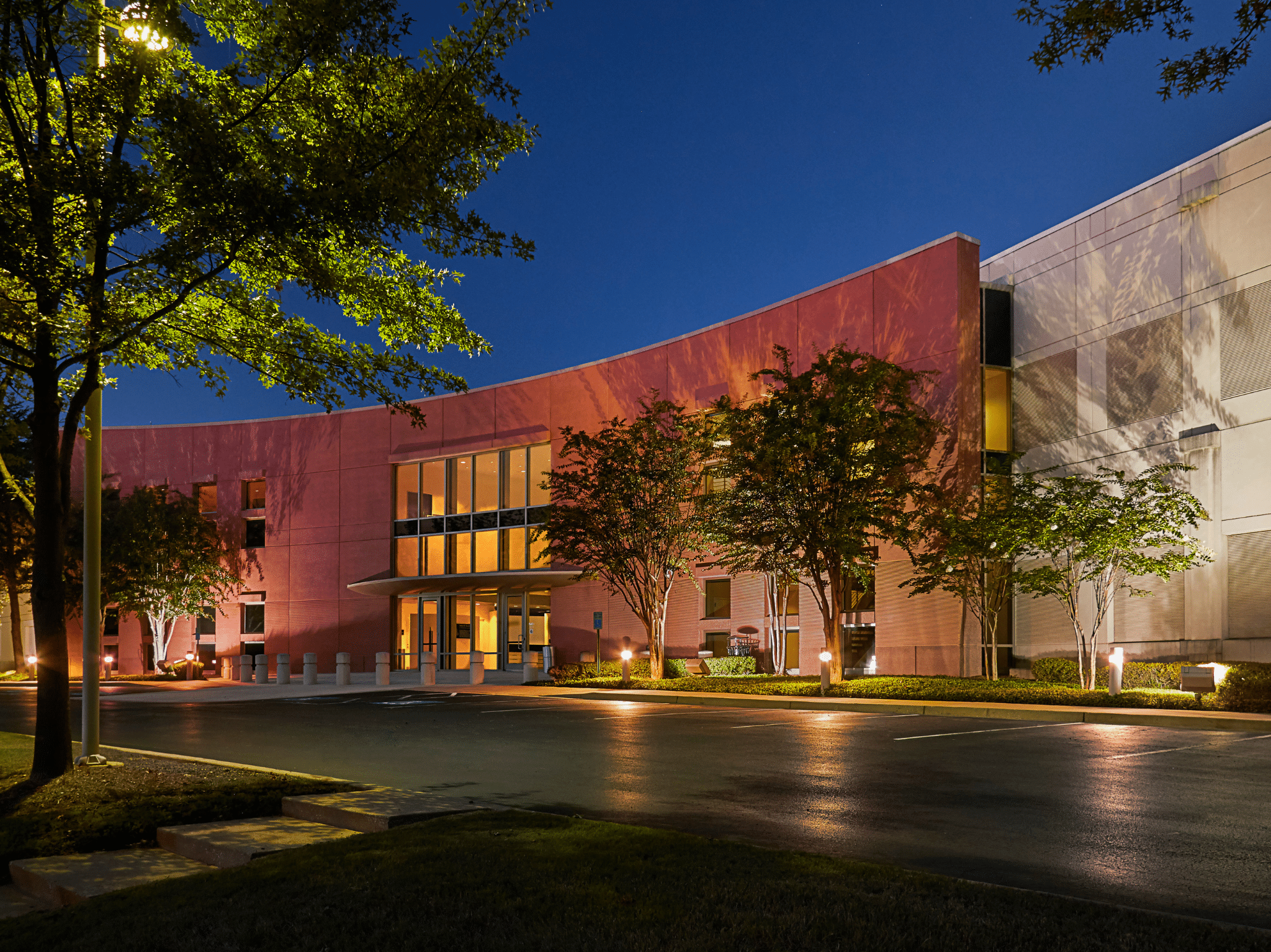

The Tucson Tech Data Center site includes a data center building situated on 8+ acres with 133,452 square feet currently consisting of 40,792 of raised floor and +/-6.562MW of critical power. Originally built in 1989, with data center phases beginning in 2004, the property has a new 15-year absolute triple net lease with TECfusions.

“The Tucson Tech Data Center is a fantastic addition to our rapidly expanding portfolio due to its ideal location in the southwest and sustainability measures. The property’s focus on sustainable data center construction, energy efficiency, and renewable power sources helps lead the data center industry toward sustainability. The demand for technology, digital storage, data transmission, and added capacity at data centers that support our digital-driven world continues to grow rapidly and we are excited about the opportunity and value this data center brings to our portfolio,” said John Regan, chief investment officer of Aphorio Carter.

About Aphorio Carter

Aphorio Carter is a Carter Funds company investing in high quality income-producing mission-critical infrastructure, data centers, switch sites and high-growth technology related real estate. Led by an experienced team that has acquired more than 125 data centers across the world, Aphorio Carter specializes in sourcing and managing accretive digital infrastructure real estate and implements systematic support services aimed to add long-term value on behalf of the investment funds the company manages. Together, the principals of Aphorio Carter have a century of real estate and transaction experience in the digital infrastructure space totaling an excess of $5.3 billion in value. Aphorio Carter targets acquisitions that are net-leased to creditworthy tenants and include wholesale, enterprise, colocation, edge, switch, and cloud data center properties – the critical real estate that powers the digital age.

Media Contact:

Stacy Sheedy

Vice President, Marketing, Carter Funds

ssheedy@carterfunds.com

813-358-5982

[1] CBRE. North American Data Center Trends H1 2023. https://www.cbre.com/insights/local-response/north-america-data-center-trends-h1-2023-phoenix